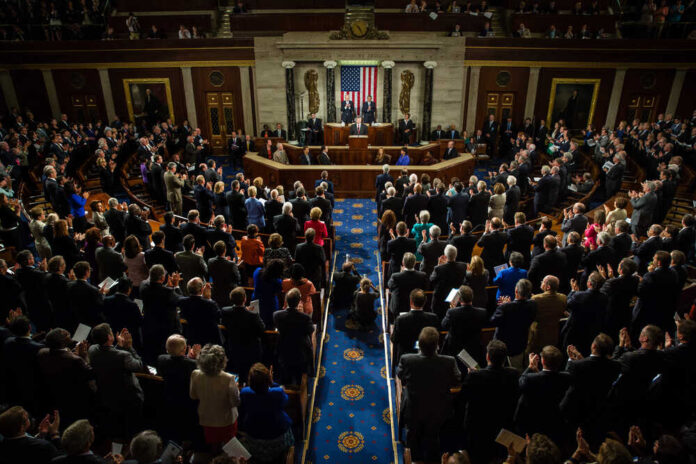

The STOCK Act, the sole federal statute governing legislators’ money, required House representatives to file financial disclosures to reveal if they had any conflicts of interest.

A new study found that more than half of the House of Representatives requested an extension on their financial reports.

A recent report by Accountable US discovered that in 2023, approximately 60% of sitting House members asked for and were granted an extension on their 2022 reports.

Republicans made up 54% of the people who requested more time to file their requests.

The extensions are legal, but the watchdog organization claims that their widespread use reveals the weak character of Congress’s present financial ethics regulations.

House Republicans have delayed taking any action on pending legislation.

Despite the worst market since 2008, several lawmakers in 2021 and 2022 outperformed the S&P 500 by taking “advantage of their position as elected officials,” according to US Accountable.

This Congress has seen the introduction of at least six bipartisan measures, including one that brought Democratic Representative Alexandria Ocasio-Cortez and Republican Representative Matt Gaetz together.

The frequent stock trades of former House Speaker Nancy Pelosi’s husband, Paul, have sparked renewed calls for a ban on congressional stock trading.

Saying it’s complicated, Rep. Chip Roy (R-TX), who authored one of the stock ban bills, recently said, “You got to get it done the right way to get the coalition together.”

Roy was critical of the newly engaged Democratic Party on this issue.

Warren Davidson, a Financial Services Committee member, said he would vote against a bill restricting stock trading.

His idiotic take was that he thinks members of Congress ought to be wiser financially, not more dumb financially. Inside information doesn’t make a person “wiser.” It makes them criminal. Trading on inside information is forbidden by law.

According to research, at least 97 members of Congress or their immediate family members made trades in firms that were directly impacted by their committees’ work.

Seventy-eight members of Congress were found to have violated the STOCK Act in January by failing to report recent trades.

Members of Congress must record any trades they make within 30 days; however, this regulation is regularly disregarded, and no consequences are given to those who break it. The maximum penalty for breaching the law is usually only about $200.

The annual financial disclosure reports also detail outside revenue, including book agreements or loans paid back from the campaign.